Overview: Arizona, Greater Phoenix, and the chip builders

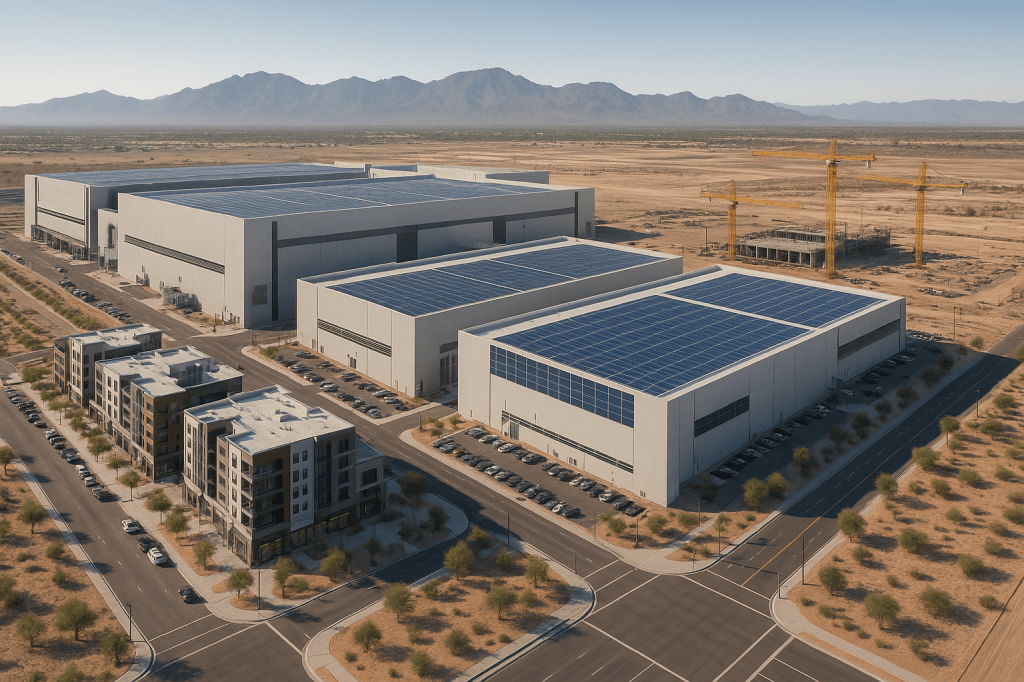

Arizona is undergoing a rapid change as large semiconductor manufacturers build new fabs and campus-style facilities in Greater Phoenix. Companies such as Intel, TSMC, Samsung, and Micron are among the major players driving construction, investment, and hiring across the region. Local leaders have even suggested adding chips as the state’s sixth C, alongside cotton, cattle, citrus, copper, and climate.

This shift matters to everyday residents. New plants bring high-paying jobs, supply-chain contracts, and construction work. They also reshape neighborhoods and local services. This article explains what is happening, why it matters, and what ordinary people should watch for in the months and years ahead.

Snapshot of the boom

Greater Phoenix is now home to multiple large semiconductor projects. These facilities range from advanced wafer fabs to campus-style supplier hubs. Key features include:

- Major capital investment by multinational firms to build or expand semiconductor production.

- Large construction programs that create short-term employment and long-term operational jobs.

- New supplier networks and logistics flows that change how local businesses interact with global manufacturing.

From the five C’s to chips

Historically, Arizona’s economy and identity leaned on cotton, cattle, citrus, copper, and climate. The arrival of semiconductor manufacturing marks a clear economic shift. Local officials and developers are rethinking land use and naming, treating chips as a new core industry for the state.

That change is more than symbolic. It signals a move toward advanced manufacturing, high-tech employment, and a different set of public investments in infrastructure and training.

Economic impact for ordinary people

The new fabs bring several types of economic effect that will touch daily life in Arizona:

- Jobs. Operational roles include engineers, technicians, and plant operators; construction roles include trades and contractors. Many jobs pay well compared with local averages.

- Supplier business. Local firms can win contracts for construction, facilities maintenance, logistics, and specialized parts.

- Spending. New employees increase demand for housing, retail, restaurants, and services around plant locations.

At the same time, the jobs require specific skills. That creates both opportunity and a challenge for local training institutions and hiring practices.

How neighborhoods and real estate are changing

Developers and companies are planning mixed-use projects near new fabs. These developments borrow elements of historical company towns, with housing, retail, and amenities close to workplaces. Key effects include:

- Higher demand for nearby housing, which can push rents and prices up in adjacent neighborhoods.

- Planned developments that combine apartments, offices, shops, and public space to attract workers and suppliers.

- Increased pressure on local services, including schools and health care, in fast-growing suburbs.

For residents, that can mean improved local amenities, alongside risks of displacement and gentrification in some areas.

Supply-chain and national-security implications

Bringing chip production onshore has strategic benefits for the United States. Domestic fabs can shorten supply lines for critical industries, reduce dependence on long overseas shipments, and offer more control over sensitive manufacturing steps.

At the same time, running modern semiconductor manufacturing domestically requires complex supplier ecosystems, access to specialty chemicals and equipment, and strong quality controls. Building those networks is a multi-year effort that involves both private firms and government coordination.

Policy and incentives: state and federal roles

Arizona’s attraction for fabs depends in part on incentives from state and federal governments. Policies that played a role include:

- Tax incentives and credits offered by state or local authorities to attract large capital projects.

- Federal funding and programs designed to encourage onshore semiconductor capacity and research partnerships.

- Local approvals and zoning decisions to enable large industrial footprints and supporting mixed-use projects.

These incentives are typical in major industrial relocations, but they also generate debate about long-term costs and benefits for taxpayers and communities.

Workforce and education: who will do the work

Manufacturing advanced chips requires a mixture of highly skilled engineers and technically trained operators. That raises several workforce issues:

- Shortages. Local schools and training programs sometimes lag behind the immediate needs for technicians and process operators.

- Training programs. Community colleges, state universities, and private training firms are expanding courses to prepare workers for fabs.

- Recruiting. Companies recruit nationally and internationally, but building pipelines from local communities can increase long-term stability of the workforce.

For residents, this means opportunities for new careers, with an emphasis on technical training and certification.

Infrastructure and environmental concerns

Semiconductor manufacturing uses significant water and energy, and it requires robust transport links. In Arizona, these requirements pose questions for sustainability and planning:

- Water. Chips production can use large amounts of purified water. This raises concerns in a region that regularly faces drought and water management constraints.

- Power. Reliable electricity is essential, including options for back-up power and long-term grid investments.

- Transport. Road and rail upgrades may be needed to move materials and supplies, and to support commuting patterns for workers.

Local governments and companies must balance industrial needs with long-term environmental stewardship and community priorities.

Risks and uncertainties

The boom in semiconductor construction is not guaranteed to be steady and without risk. Main uncertainties include:

- Boom-bust cycles. Large-capital projects can lead to rapid growth followed by slowdowns if demand shifts or if global competition intensifies.

- Dependence on a few companies. Local economies that concentrate on a small number of large employers can become vulnerable if those firms change strategy.

- Global competition. Other regions are also investing heavily in chips, which influences long-term pricing, capacity, and supply-chain choices.

These risks suggest that diversification, strong local policy, and community engagement will be important as the region grows.

What this means for startups, investors, and local communities

There are distinct opportunities and cautions for various groups:

- Startups. Proximity to fabs can help hardware and semiconductor-related startups by reducing prototyping time and strengthening partnerships with suppliers.

- Investors. The growth offers investment opportunities in construction, real estate, and service businesses, but these come with cyclical risk.

- Communities. Residents can gain jobs and improved services, but they should advocate for housing affordability, local hiring, and environmental protections.

Practical actions residents and officials can take

- Support targeted training programs that connect local workers to manufacturing jobs.

- Push for developments that include affordable housing and community services.

- Encourage transparent reporting on water and energy use, with plans to mitigate environmental impact.

Key takeaways and FAQ

Key takeaways:

- Greater Phoenix is becoming a major center for semiconductor manufacturing, driven by new fabs from large global firms.

- The shift brings high-paying jobs, supplier opportunities, and substantial construction, but it also creates pressures on housing, water, and local services.

- Local and federal policies matter. Incentives, training programs, and infrastructure investment will shape whether benefits spread widely.

- Residents should watch for community benefits agreements, workforce pipelines, and environmental safeguards.

FAQ

Q. Will chip jobs replace other Arizona industries? A. Chips will add a significant new industrial base, but it is unlikely to replace agriculture and other established sectors entirely. The economy will become more mixed.

Q. Are these fabs good for small businesses? A. They can be. Suppliers, logistics firms, and service providers often gain new customers, but competition and rising costs can also challenge small businesses.

Q. What about water use? A. Water is a concern. Companies and regulators will need to plan for sustainable use and conservation, given Arizona’s climate realities.

Conclusion

Greater Phoenix’s new semiconductor plants are reshaping the economy, the built environment, and everyday life. For many residents, that will mean new job paths, more local investment, and changes in neighborhood character. For policymakers and community leaders, the task is to ensure the growth is managed so that benefits reach a broad set of people, while protecting resources and avoiding short-term downsides.

The rise of chip manufacturing in Arizona is not simply a business story. It is a test of how a region can integrate advanced industry into community planning, workforce development, and environmental stewardship. Paying attention now can help shape better outcomes in coming years.

Leave a comment