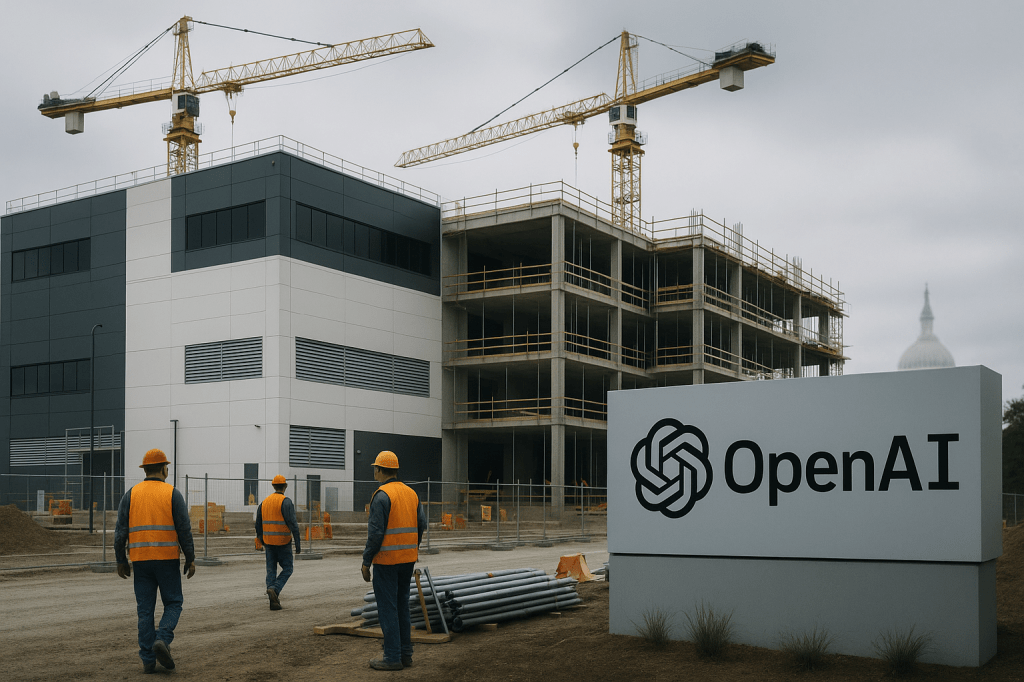

Overview: what happened and who is involved

OpenAI sent a formal letter to the Trump administration requesting that tax credits under the CHIPS Act be expanded to include investments in data center construction. The request, reported by TechCrunch, would let companies claim a tax credit for the capital costs of building large facilities that host AI training and inference hardware.

This is a government policy question that involves several named actors, including OpenAI, the White House, the Department of the Treasury, members of Congress who oversee CHIPS Act implementation, and cloud providers that host AI workloads. The immediate aim is to lower the upfront cost of AI infrastructure and speed construction of facilities that support large scale model training and deployment.

What OpenAI asked for, in plain language

OpenAI asked the administration to broaden eligibility rules for the CHIPS Act tax credit so that spending on data center construction would qualify. That would mean a portion of the costs to build or upgrade facilities used to house servers, networking, and cooling for AI systems could be offset through a tax credit.

The company frames the request as a way to reduce capital expenses tied to rapidly expanding compute capacity, which supports both model training and the real time processing that lets AI services respond to users.

What the CHIPS Act currently covers

The CHIPS and Science Act was passed to strengthen semiconductor manufacturing and research in the United States. The law includes a tax credit program that helps lower the cost of building semiconductor fabs and related equipment. The original policy goal was to increase domestic chip production and reduce dependence on overseas manufacturing.

As the program was written, credits target semiconductor production and associated supply chain investments. Expanding the definition to include data centers would change how that federal incentive is applied, and it would be an administrative or legislative decision to do so.

Why OpenAI wants the change

- Lower capital costs. Building large scale data centers is expensive. A tax credit would reduce up front capital requirements and help accelerate construction.

- Faster infrastructure for AI. More facilities mean more capacity for training large models and running services at scale, which OpenAI says it needs for growth.

- Competitive stability. Access to lower-cost infrastructure could help OpenAI and its partners deploy capabilities without being as constrained by capital intensity.

Policy context and legal hurdles

Changing CHIPS Act eligibility can follow different paths. An executive branch agency could attempt an administrative interpretation that broadens the credit, but that risks legal challenge because the statute specifies chips and semiconductor activities. A more durable route would be action by Congress to amend the law and explicitly add data center investments.

Any change would likely trigger debate among lawmakers about the original intent of CHIPS funding, the appropriate scope of industrial policy, and whether taxpayer money should subsidize private infrastructure that primarily benefits a few companies.

Economic implications

Tax credits that cover data center construction would affect the economics of AI infrastructure in several ways.

- Lowered cost of entry. New entrants and existing firms would face lower initial investment hurdles, which could speed expansion across regions.

- Competition among cloud providers. Companies that host AI workloads may win or lose depending on how credits are applied, which could reshape bargaining power and pricing for AI services.

- Potential market distortion. Subsidies can shift investment toward subsidized activities even when market signals would point elsewhere. That may favor certain types of infrastructure over alternatives, such as more energy efficient designs or distributed compute models.

Energy, grid, and environmental concerns

Rapid growth of data centers affects local electricity demand, grid stability, and environmental impact. Large AI training clusters consume significant energy, especially when used for continuous model training.

- Grid demand. New facilities can strain transmission and distribution networks; utilities may need to upgrade lines and substations.

- Electricity costs. Higher demand can raise wholesale prices in some regions unless paired with new generation or long term contracts.

- Environmental impact. If new capacity relies on fossil fuel generation, expanding data centers could increase emissions. Alternatively, pairing credits with clean energy requirements would change that outcome.

Political optics and questions of fairness

The idea of using a semiconductor support program to subsidize private data centers raises political questions. Voters and lawmakers may ask whether public funds should reduce costs for profitable private companies. Public sentiment often turns against perceived corporate giveaways when the benefits are concentrated.

Equity issues matter as well. If credits lead to a surge of data center construction in certain regions, communities without adequate oversight could face noise, water use, or land use impacts. Conversely, some regions could gain jobs and investment.

Precedent and regulatory risk

Expanding CHIPS credits to data centers could create precedent. Other industries might seek similar treatment, arguing their investments enable national competitiveness. That could widen demands on federal incentive programs, and raise questions about limits and criteria for public support.

Legal challenges are also possible. If an administrative agency tries to reinterpret statute language, affected parties or oversight entities could sue, delaying any implementation and creating judicial review that determines how broadly such programs may be applied.

Who is watching and why

- Federal officials. Treasury, the White House Office of Management and Budget, and agencies charged with CHIPS implementation must weigh legal, budgetary, and policy implications.

- Members of Congress. Lawmakers who wrote or fund CHIPS will play a role if the change requires statutory amendment.

- Cloud providers and rivals. Companies that run hyperscale data centers will follow the proposal closely; some may support it, others may oppose it depending on how rules are written.

- Utilities and grid operators. These organizations assess capacity, upgrades, and the timing of demand increases tied to new facilities.

- Advocacy groups. Environmental and consumer advocates may raise concerns about emissions, local impacts, and fairness of subsidies.

Possible outcomes and a realistic timeline

There are several ways this request could play out, each with different timelines.

- Administrative clarification. An agency could interpret existing rules more broadly. That would be the fastest route, but it risks legal challenge and might be limited in scope.

- Legislative amendment. Congress could vote to explicitly extend CHIPS credits to data center investments. That would be slower, requiring debate and appropriation, but would produce clearer legal footing.

- Rejection. Officials could decline to act, leaving CHIPS credits focused on semiconductor manufacturing and related activities.

Timing depends on political priorities, the legal appetite for reinterpretation, and lobbying from stakeholders. Administrative steps could occur in months, while legislation would likely take longer and depend on the congressional calendar.

Scenarios to watch

- Partial accommodation. Credits are allowed for data center investments with strict limits or clean energy conditions.

- Full expansion. Credits apply broadly to eligible data center capital expenditures, inviting rapid construction.

- Targeted pilot. A temporary pilot program tests the effect in select regions or projects before broader action.

How this matters to ordinary readers

Most people will not directly claim these tax credits, but effects could reach consumers through higher or lower prices for cloud services, changes in where data centers are sited, and impacts on local jobs and utility rates. Energy use and environmental outcomes matter to communities that host new facilities.

If credits accelerate AI infrastructure, users may see faster rollout of AI-powered products and services, but those advances come with trade offs in energy demand and potential concentration of economic benefits.

Key takeaways

- OpenAI asked the Trump administration to broaden CHIPS Act tax credits to cover data center construction, aiming to lower costs for AI infrastructure.

- The CHIPS Act was designed to support semiconductor manufacturing; expanding it raises legal and political questions.

- Economic effects include lower capital costs, possible competition shifts among cloud providers, and risk of market distortion.

- Energy and environmental concerns are central, because data centers can drive large increases in electricity demand.

- Outcomes range from administrative reinterpretation to legislative change, each with different legal and political implications.

FAQ

Will taxpayers directly pay OpenAI? No direct payments are proposed. A tax credit reduces tax liability for qualifying investments, which lowers the effective cost of projects for the companies involved.

Could this increase electricity bills locally? Potentially, if utilities invest in upgrades and recover costs through rates. It depends on how projects are financed and how regulators permit cost recovery.

Does this guarantee more AI jobs? Data center construction and operation can create local jobs, but many roles are specialized. Long term employment impacts vary by region and project design.

Conclusion

OpenAI’s request to broaden CHIPS Act tax credits to include data center construction highlights a growing policy tension. Governments must weigh how to support strategic technology capacity while protecting taxpayers, managing energy systems, and preserving fair competition.

Decisions will shape where AI compute is built, who benefits economically, and how fast new AI services arrive. Watch for statements from Treasury, members of Congress who oversee CHIPS funding, utilities, and cloud providers as this issue moves from a letter into the policy process.

Leave a comment