Overview: who is involved and why this matters

A majority of consumers now say they worry that data centers and AI workloads will drive up household electricity costs. Key actors include cloud providers, large data center operators, utility companies, local governments, and the people living near new builds. Recent trends show rising wholesale electricity prices and faster growth in data center electricity use, driven in part by training large AI models and running continuous inference services.

This story matters for ordinary readers because electricity bills, local permitting, and grid reliability are visible, tangible costs. If utilities face higher peak demand, they can pass costs to customers. If communities resist new data center permits, deployments can stall and cloud customers may see higher prices or constraints on where computing capacity can expand.

How AI and data centers affect electricity demand

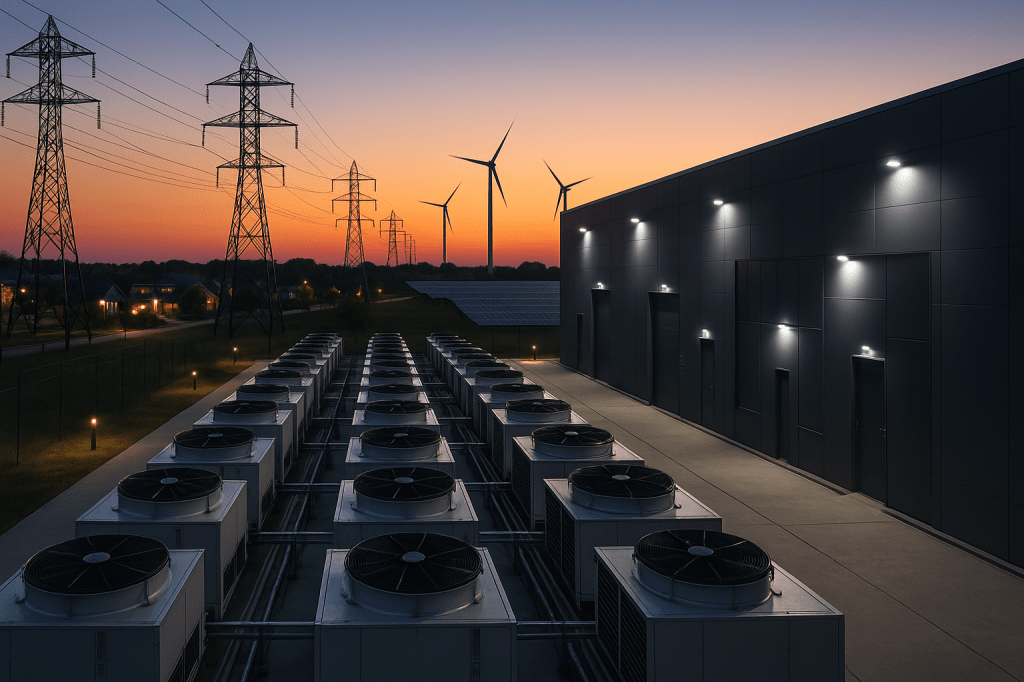

Data centers are facilities that house servers, storage, and networking gear. Modern AI workloads use specialized chips and accelerators, such as GPUs. These chips draw substantial power during training and inference, and they require significant cooling to stay within safe operating temperatures.

Key technical drivers of higher energy use include:

- High-power accelerators, used for model training and for large-scale inference services.

- Continuous workloads, such as chatbots and recommendation engines, that run 24 hours per day.

- Cooling systems, which can account for a large share of a facility’s total energy use when ambient temperatures rise.

Why rising wholesale prices translate into household stress

Wholesale electricity prices are set by supply and demand on regional grids. When demand spikes, or when fuel and transmission costs rise, wholesale prices go up. Utilities often recover those higher costs through retail rates, which can increase monthly bills for households and businesses.

For regions with constrained grids, adding large new loads from data centers can intensify peak demand. That can require utilities to invest in transmission upgrades, peaker plants, or storage; those investments often show up in rate cases and can affect consumer bills over time.

Regional hotspots and community exposure

Some parts of the country or the world see more data center construction and have weaker grid capacity. Those places become hotspots for potential conflict between developers and residents. Communities that rely on older infrastructure, or that already face high electricity costs, are more exposed to quick increases in local demand.

Factors that raise local exposure include:

- Concentrations of data centers near metropolitan or suburban areas.

- Regions with limited transmission capacity or frequently tight supply margins.

- Places where new data center growth outpaces local planning and permitting processes.

How the industry is responding

Cloud providers and data center operators are using several strategies to manage energy use and to reduce political and financial risk. These responses affect the pace and shape of data center growth, and they shape how costs are allocated.

- Efficiency gains. New chips and system designs can deliver higher performance per watt. Operators also tune software and workload placement to be more energy efficient.

- Shifting workloads. Some nonurgent workloads can be scheduled for off-peak hours, reducing pressure on the grid during high-demand periods.

- Renewables and storage. Investments in solar, wind, and battery storage can offset grid demand and reduce exposure to volatile wholesale prices.

- On-site solutions. Some sites invest in on-site generation or heat reuse projects to make operations more local and less grid dependent.

Examples of technical measures

- Liquid cooling and other advanced cooling systems can reduce energy used for temperature control.

- Power management at the software level can throttle noncritical processes during peaks.

- Energy-aware scheduling tools can place GPU-heavy jobs where and when power is cheapest.

Business and public relations risks

Cloud providers and hyperscale operators face business risks if consumers see their growth as a direct cause of higher bills. These risks include local opposition to new builds, delays in permitting, and damage to corporate reputation. Even if a provider sources renewables overall, the timing and location of demand can still strain local grids and spark pushback.

Companies that do not provide clear, local-level information about energy use and mitigation plans are more likely to face scrutiny. Conversely, transparent reporting and early local engagement can reduce friction during development.

Policy levers and regulatory tools

Regulators and utilities have tools to steer outcomes. Policy choices influence whether the costs of new loads fall on the operator, on ratepayers, or on taxpayers. Key levers include:

- Grid planning, which can prioritize upgrades where demand is expected to increase.

- Demand charges and time of use pricing, which make customers pay more for peak demand.

- Incentives for clean on-site generation, which can encourage local renewables and storage paired with data centers.

- Transparency and reporting requirements, which can require clearer disclosure of where and when data centers draw power.

Opportunities for startups and local services

New business opportunities are appearing for companies that help AI and data center operators be kinder to the grid. These include startups offering energy-aware machine learning tooling, services that capture and reuse data center heat, and co-location providers that emphasize grid-friendly operations.

These business models aim to align commercial growth with local electricity constraints, reducing the chance of community pushback and regulatory friction.

What ordinary readers should watch for

If you care about your electricity bill, or if you live near a potential data center site, watch for these signals:

- Announcements of new data center builds in your city or county.

- Local utility rate cases or notices about grid upgrades tied to new large customers.

- Public comments and permitting meetings where operators present energy and local impact plans.

- Transparency reports from cloud providers about the timing and location of their electricity use.

Actionable guidance for different audiences

Each group can take specific actions to reduce risk and improve outcomes. Below are practical steps for regulators, companies, and consumers.

For regulators and utilities

- Require clear, geolocated reporting so communities can see how much power new data centers will draw and when.

- Use demand charges and time of use signals to encourage load shifting and on-site storage.

- Plan upgrades proactively in regions expecting growth, and factor in both peak and continuous load profiles.

For companies and cloud providers

- Publish local plans for renewables, storage, and workload timing, not just aggregate emissions claims.

- Invest in efficiency, such as newer chips, liquid cooling, and smarter scheduling tools.

- Engage early with communities and local leaders to explain mitigations and to identify shared benefits such as jobs or infrastructure investment.

For consumers and community groups

- Ask local officials and utilities for clear assessments of how new data centers will affect rates and reliability.

- Push for conditions on permits that require grid-friendly measures, like on-site storage or commitments to off-peak workload shifting.

- Watch corporate reports for evidence of local investment in clean energy and transparency about timing of demand.

Key takeaways

- A majority of consumers are worried that data centers and AI workloads will raise household electricity bills.

- AI training and continuous inference use specialized chips that increase both power draw and cooling needs.

- Rising wholesale prices and constrained grids can make new data center demand visible in local rates and planning debates.

- Industry responses include efficiency gains, workload shifting, and investments in renewables and storage, but transparency and local engagement remain crucial.

- Regulators, companies, and communities each have practical steps they can take to reduce conflict and protect consumers.

FAQ

Q: Will data centers directly cause my home electricity bill to rise?

A: Not necessarily. Bills change for many reasons, including fuel prices and grid investments. However, if a region adds several large data centers and the grid needs upgrades, those costs can be reflected in rates over time.

Q: Are cloud providers doing anything to reduce local pressure on grids?

A: Yes. Many providers invest in efficiency, renewables, and storage, and they are experimenting with workload timing. The effectiveness of these measures depends on local implementation and transparency.

Q: What can my community demand from a data center developer?

A: Ask for geolocated energy use forecasts, commitments to on-site renewables or storage where appropriate, plans for off-peak workload scheduling, and community benefits tied to infrastructure or job creation.

Conclusion

Rising energy prices have put a spotlight on the electricity needs of data centers and AI workloads. For consumers and communities this is not an abstract issue. It affects bills, local permitting, and grid reliability. The industry has tools to reduce pressure on grids, including efficiency improvements, renewable investments, and smarter workload scheduling. Regulators and local leaders can shape outcomes by requiring transparency and by using rate and planning tools that reward grid-friendly behavior.

Watching developments at the local level, asking for clear, location-specific information, and supporting policies that align new computing demand with clean energy and storage can help ensure that AI growth does not translate into higher costs or strained local infrastructure.

Leave a comment