Overview: OpenAI, Oracle, Project Stargate and the reported $300 billion pact

The Verge reports that OpenAI and Oracle have signed a contract for OpenAI to buy roughly $300 billion in computing capacity from Oracle over about five years, with purchases beginning around 2027. The agreement is tied to Project Stargate, a broader initiative that involves SoftBank and other partners. Oracle has already shown a sharp rise in future contract revenue projections and market reaction following the report.

This article explains the reported deal, why it matters for everyday people, and the likely effects on cloud providers, hardware supply chains, datacenters, energy use, and public policy. Key names and facts appear in the first paragraphs, so readers have the core information up front.

What the reported deal says, in plain language

According to the report, OpenAI will buy about $300 billion worth of compute from Oracle over roughly five years, starting in 2027. The contract is part of Project Stargate, which links OpenAI with other investors and partners, including SoftBank. Details about pricing, exact volumes, and whether the deal is exclusive have not been disclosed publicly.

At face value, this would be one of the largest single cloud contracts ever recorded. It reflects the intense demand for specialized compute resources needed to train and run advanced AI models.

Key components mentioned in reports

- Reported total value: approximately $300 billion over five years.

- Start timeframe: roughly 2027 discussed in reports.

- Project connection: part of Project Stargate, with involvement from SoftBank and others.

- Impact on Oracle: immediate boost to future contract revenue estimates and stock market reactions.

- Unknowns: exact pricing, exclusivity, hardware types, service levels, and legal terms.

Why this matters to ordinary readers

Most people will not buy cloud compute in the same way as OpenAI, but this deal matters because it helps set where the next generation of AI services will be built and hosted. Large, long term contracts influence which companies control critical AI infrastructure, the cost of cloud services, and even where new datacenters get built.

Concrete effects you could see in daily life include faster rollout of AI features in consumer apps, higher corporate spending that may change pricing for other cloud customers, and more public focus on energy use and local datacenter siting.

Who stands to win and who may lose

Winners likely include Oracle, which expects a large increase in future contracted revenue if the reported figures hold. Oracle may gain market credibility for handling large AI workloads, and that could attract more enterprise clients.

Other players face pressure. AWS, Microsoft Azure, and Google Cloud will likely compete harder for AI customers. That could mean more aggressive pricing, new specialized hardware offers, or custom infrastructure contracts to keep major customers from shifting workloads.

Potential winners

- Oracle, for revenue and credibility in AI infrastructure.

- Hardware suppliers who win follow on contracts to build servers and chips for Oracle and OpenAI.

- Datacenter operators and local economies that host new facilities.

Potential losers or pressured parties

- Competing cloud providers facing a large, long term customer moving significant workloads elsewhere.

- Smaller cloud customers if prices rise or capacity is prioritized for very large AI buyers.

- Supply chain participants if production cannot scale to meet peak demand, creating shortages or higher prices.

Technical and supply chain implications

Large AI model training requires specialized hardware, including GPUs and AI accelerators. The reported Oracle-OpenAI deal is likely to be linked with other hardware agreements OpenAI has pursued, for example with chip vendors reported previously. That means supply chains for semiconductors, memory, and power delivery will see significant demand.

Practical outcomes could include custom server designs optimized for OpenAI models, longer lead times for key parts in other industries, and faster investment in new chip fabs or assembly lines.

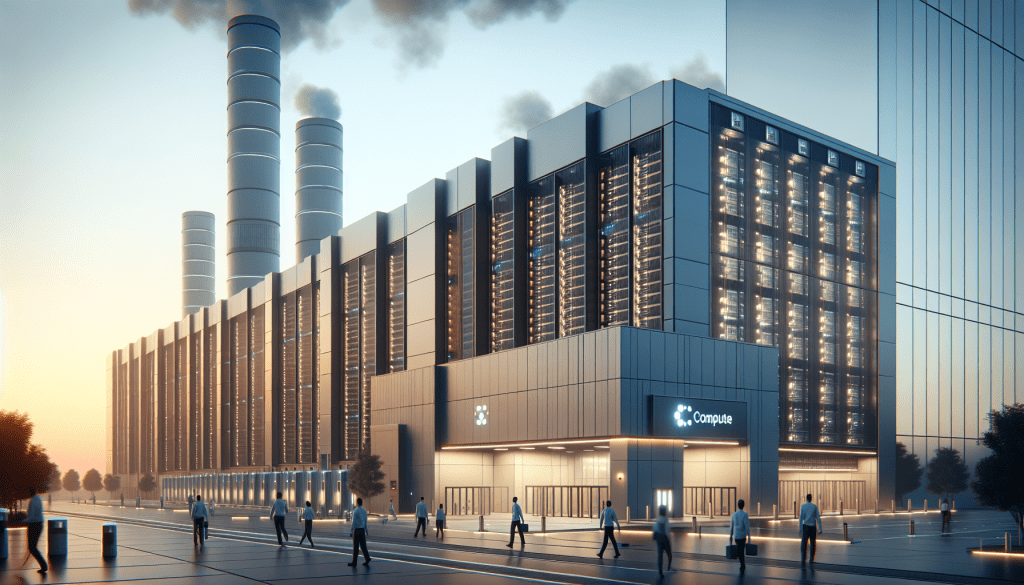

Datacenter scale and energy considerations

Reports suggest the datacenter and power needs involved could reach multi gigawatt scale over time. That is large enough to affect local electricity grids and spur planning for power generation and cooling infrastructure.

Key points about environmental and community impacts:

- Energy demand: Large-scale AI compute can require sustained high power levels; utilities and regulators will need to plan capacity and grid upgrades.

- Location choices: Datacenters often locate where power is stable and affordable; this influences local jobs and land use decisions.

- Carbon footprint: Operators may pursue renewable energy contracts or offsets; how much of the power will be low carbon is not public in the reported deal.

Regulatory and geopolitical risks

Concentrating massive AI compute with a single vendor raises policy questions. Antitrust authorities may examine whether a dominant supplier agreement could reduce competition. National security agencies could be concerned about the concentration of advanced compute that underpins capabilities in many sectors.

Other risks include export controls on advanced chips and political scrutiny if key datacenters are built in sensitive locations. Regulators may seek transparency about dependency on specific suppliers for critical infrastructure.

What remains uncertain

The public reporting contains many unknowns. The $300 billion figure may be preliminary, and the contract terms could change. Areas that are not yet clear include:

- Exact pricing per unit of compute, and whether volume discounts or penalties apply.

- Whether the deal grants exclusivity to Oracle for certain OpenAI workloads.

- Hardware specifics, such as which chips or accelerators will be used, and whether custom designs are planned.

- Precise start dates for large capacity buildouts, and staged timelines for delivery.

- Environmental commitments tied to power sourcing or emissions reductions.

Because of these unknowns, analysts will continue to watch filings, company statements, and regulatory notices for confirmation and more detail.

Key takeaways

- The reported OpenAI Oracle contract is about $300 billion over five years, starting around 2027, and is part of Project Stargate with partners including SoftBank.

- It would be one of the largest cloud deals ever, and could shift market power in cloud infrastructure and AI services.

- Expect pressure on competing cloud providers, increased demand for specialized hardware, and significant datacenter and energy planning requirements.

- Regulatory and national security review could follow, because centralizing large compute capacity raises competition and security questions.

- Important details on pricing, exclusivity, and environmental terms are still not public, so the full impact will emerge over time.

FAQ

Will this deal change the AI services I use on my phone or in web apps?

Possibly. If OpenAI secures large, stable compute, it may accelerate rollouts and performance of AI features in apps that rely on OpenAI models. The effect will depend on how OpenAI chooses to commercialize those services and how developers integrate them.

Does this mean Oracle will control the future of AI?

Not by itself. A single large contract gives Oracle a major customer and revenue stream, but the AI ecosystem includes many cloud providers, chipmakers, and software firms. Market competition will continue to shape who controls specific aspects of AI infrastructure.

Should local communities worry about new datacenters?

Local impacts include jobs and tax revenue, but also higher power demand and land use changes. Communities and utilities should engage early with developers to plan power, water, and environmental mitigation.

Could regulators block or limit this kind of deal?

Yes. Antitrust and national security regulators can review large infrastructure agreements, and may impose conditions if they find competition or security concerns.

Conclusion

The reported OpenAI and Oracle agreement under Project Stargate, at around $300 billion over five years, would be a landmark cloud contract. It speaks to how critical compute capacity has become for advanced AI, and it has practical effects on competition, hardware supply chains, datacenter planning, and public policy.

Many details remain uncertain, so observers should expect updates in regulatory filings, corporate disclosures, and industry reports. For ordinary readers, the main things to watch are changes in cloud pricing and performance, local datacenter activity, and any policy debates about concentration of AI infrastructure.

Leave a comment